Financial Statement 2019 – Company in Poland, complete guide.

Currently, Financial Statement of Polish Limited Liability Company and all other related financial documents have to be prepared and submitted to the National Court Register only in electronic form. It is no longer possible in any circumstances to submit financial documents of company in Poland in paper form to register. This makes the whole process multistage and demanding certain conditions met.

What is needed to submit Financial Statement – technical / organizational requirements

Electronic Signature

First and basic requirement is electronic signature. Each member of the Management Board of Polish company has to have:

- qualified electronic signature (the signature purchased from the certified supplier of qualified certificates in Poland);

or - “Polish Trusted Profile” which enables signing financial documents

EKRS profile

Secondly, it is necessary to create profile in Polish National Court Register online system – “EKRS” https://ekrs.ms.gov.pl/

To create profile in EKRS you have to follow these steps:

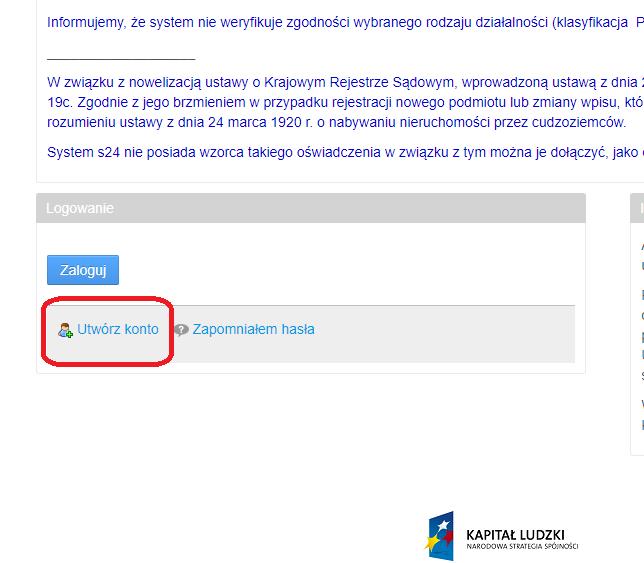

- Visit site: https://ekrs.ms.gov.pl/s24/web/guests/strona-glowna

- Scroll to the bottom of page.

- Press “Utwórz konto” button.

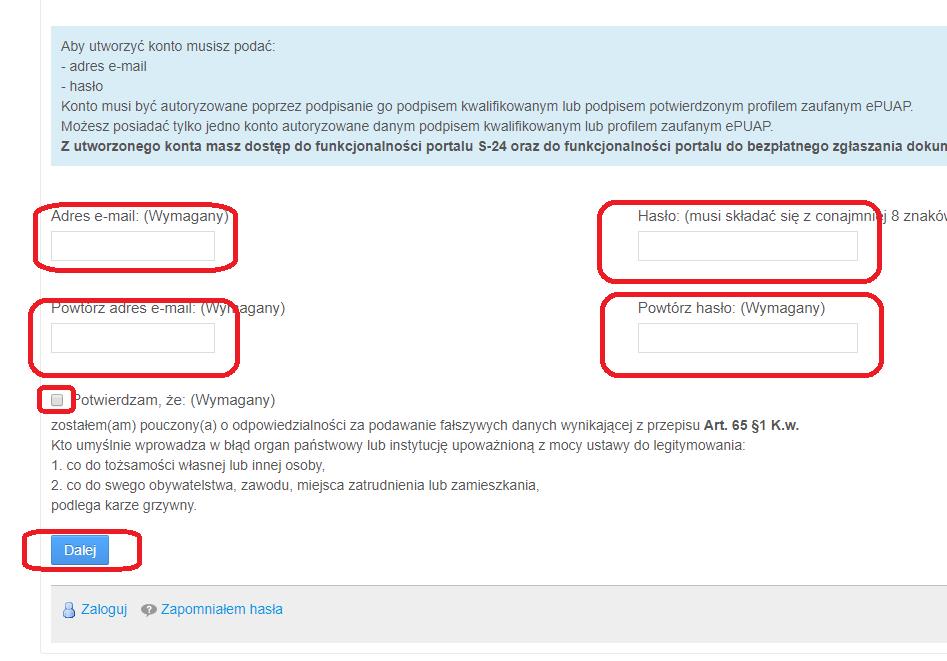

Fill gaps: email, confirmation of email, password (1 big letter, 1 number, min 8 signs), confirmation of password. Next, fill out check out and press “Dalej” button.

Use electronic signature (qualified signature or trusted profile) to authorize EKRS profile

Financial statement of Polish LLC important dates

Financial statement of Polish LLC has to be prepared within 3 months of the tax year. If the company’s financial year corresponds to the calendar year, Financial Statement should be prepared by 31st March. Moreover, in opinion of our law firm financial statement should be also signed by electronic signature by 31st March by all member of the Management Board.

Next, financial statement has to be approved by the Shareholders Meeting of LLC in Poland. The annual financial statement of company should be approved not later than within 6 months from the end of the financial year, i.e. until 30 June (if the financial year corresponds with the calendar year).

After approval of the financial report, all financial documents for previous tax year has to be submitted to National Court Register (pl: “KRS”) within 15 days from the date of approval by Shareholders Meeting, not later than 15 July (if the financial year corresponds with the calendar year).

Submitting financial statement of Polish Limited Liability Company in 2019 step by step

- Preparation of Financial Statement in special electronic form (XML) and signing by all members of the Management Board before 31st March.

- Preparation of Management Board Annual Report in any type of electronic form (for example PDF) and signing by all members of the Management Board before 31st March.

- Preparation minutes from General Shareholder Meeting (in that case it is accepted scanned copy without electronic signature), consists of:

- Resolution of the Shareholder Meeting on approval Financial Statement and Management Board Annual Report

- Resolution of the Shareholder Meeting on the distribution of profit or the coverage of loss (Shareholder Meeting);

- Submitting all above mentioned documents in EKRS system before 15th July 2019.