Small Payment Institution in Poland

The Small Payment Institution in Poland (“Mała Instytucja Płatnicza”) was implanted into Polish legal system by the amendment to the Polish Act on Payment Services in accordance with PSD2 Directive.

Small Payment Institution in Poland is used to operate in the field of providing payment services in a smaller size. It is a very good solution for those entrepreneurs which would like to check in practice the functioning of the planned business activity of payment services in Poland. The Polish Supervisory Body even called it a regulatory sandbox which is recommended primarily for all kinds of start-ups in Poland, especially from the FinTech industry.

Payment services

Small Payment Institution in Poland may provide following services:

- Services enabling cash to be placed on a payment account as well as all the operations required for operating a payment account.

- Services enabling cash withdrawals from a payment account as well as all the operations required for operating a payment account.

- Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider:

- (a) execution of direct debits, including one-off direct debits;

- (b) execution of payment transactions through a payment card or a similar device;

- (c) execution of credit transfers, including standing orders.

- Execution of payment transactions where the funds are covered by a credit line for a payment service user: (a) execution of direct debits, including one-off direct debits; (b) execution of payment transactions through a payment card or a similar device; (c) execution of credit transfers, including standing orders.

- Issuing of payment instruments and/or acquiring of payment transactions.

Limitations

First of all, the average total amount of payment transactions from the previous 12 months carried out by the Small Payment Institution, may not exceed an amount equivalent to EUR 1 500 000 per month. If this limit is exceeded, Small Payment Institution should either reduce the scale of operations or apply for the status of a “full” National Payment Institution (pl: “Krajowa Instytucja Płatnicza”)

Secondly, the Small Payment Institution may store users funds on payment accounts, which total amount can not exceed the equivalent in Polish currency of EUR 2.000.

At the end, the Small Payment Institution may operate only at the territory of the Republic of Poland. In other words, a payment service provided by a SPI should be carried out entirely by it within the territory of the Republic of Poland, i.e., the payment service cannot cross the border. For example if a SPI renders payment service of transfer of funds, such transfer cannot by cross-boarder.

Moreover, SPI cannot conduct activities in the form of a branch or through an agent in another member state.

Requirements

Obtaining license to operate as Polish Small Payment Institution is less formal than other payment licenses.

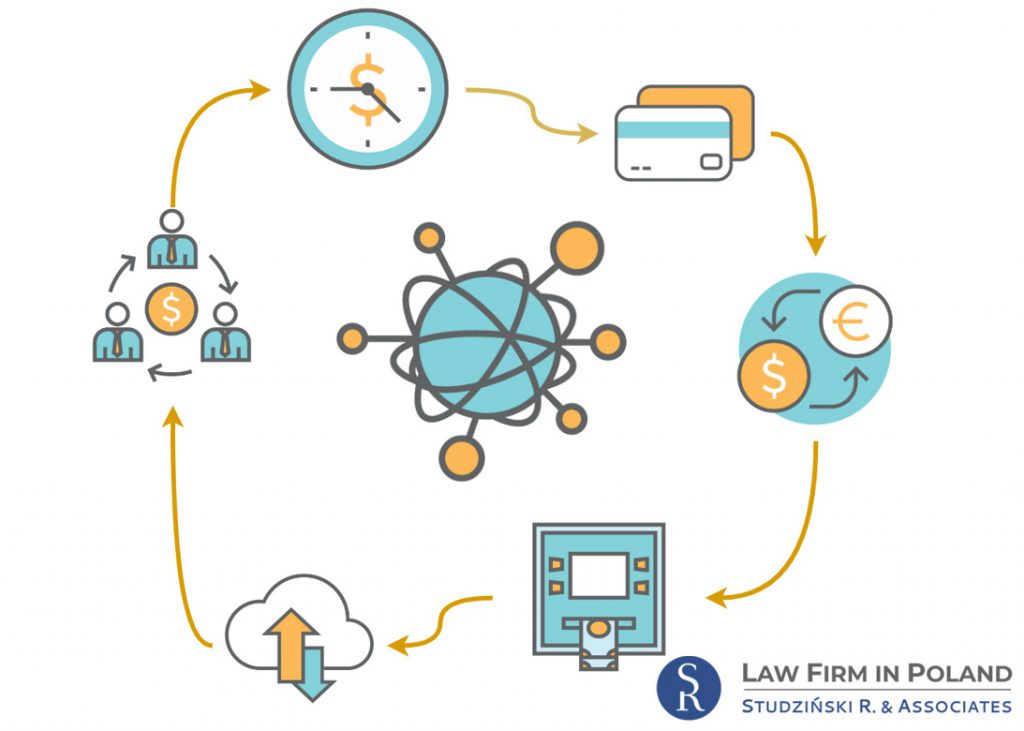

The application for entry in the register of Small Payment Institution in Poland should be accompanied by a presentation of planned payment services. This presentation has to have form of graphic diagram with a description of payment services. It should indicate the entities participating in the process of providing the payment service and describe the flow of funds and information in the process.

Moreover, entry in the register of Polish Small Payment Institution is subject to stamp duty in the amount of PLN 616.