Quarterly report of VASP in Poland, final form

At the beginning of 2024, final form of quarterly report of VASPs in Poland was published. Access to the form is reserved only via Polish Regulator online webpage system. Moreover form available is only in Polish language version. This article contains:

- Information about obtaining access to GIIF’s online system, including submitting identification form of Polish VASP;

- list of questions in quarterly statistical report with chronological order in following form:

- at the beginning question is indicated translation and elaboration;

- below question is print screen from form with google translation of that question into English language.

Submitting identification form of VASP

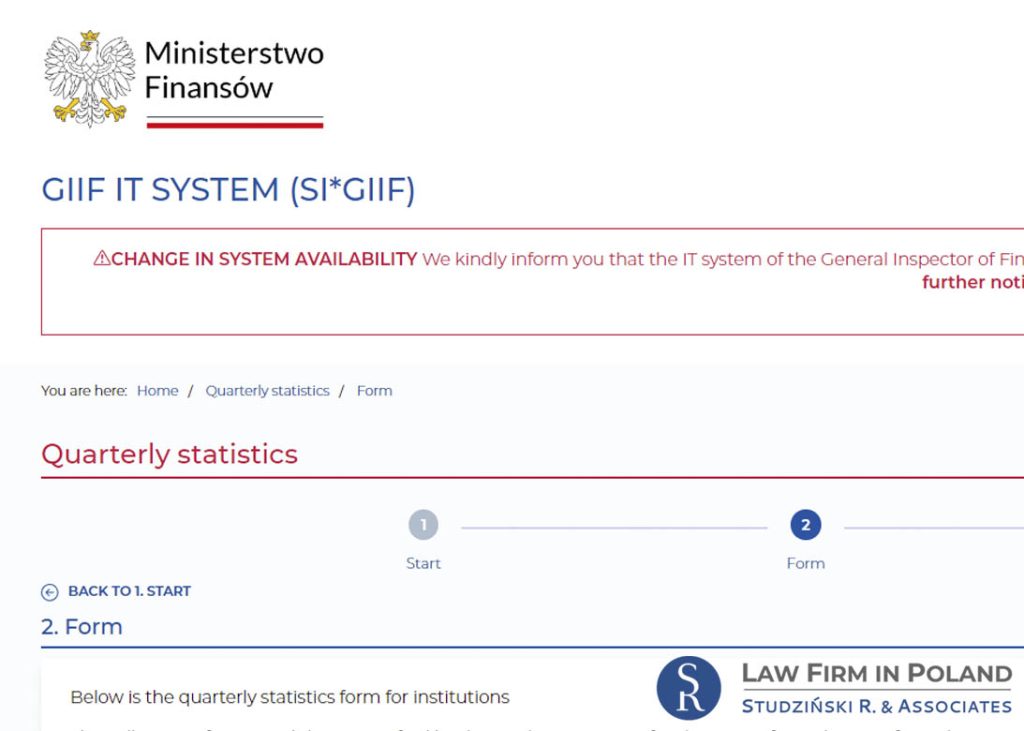

First of all, to submit quarterly form, identification of VASP in online system of Polish regulator has to be conducted. Therefore, first step is submitting identification form in GIIF website system: https://www.giif.mofnet.gov.pl/#/glowna. System is working on business days, 7:00-17:30. Moreover, as of my best knowledge it blocks IP from other than Polish state.

Identification of VASP may be submitted only by person who has qualified electronic signature. Polish Trusted Profile (electronic signature used to incorporate VASP) is not enough in that regard. Moreover, I am not able to confirm if qualified electronic signatures issued by providers outside of Poland will work with GIIF’s online system. Here is link to Polish provider of qualified electronic signature which is compatible with GIIF’s online system: https://szafir.kir.com.pl/eshop-web/en/items.html?id=3

In identification form has to be provided following information:

1) name (company), including determining of the organisational form of the obligated institution;

2) NIP of the obligated institution;

3) determining of the type of activity carried out by the obligated institution;

4) address of the registered office or address of the business activity;

5) name, surname, position, telephone number and address of electronic mailbox of the employee referred to in Article 8 of Polish AML Act (AML Officer);

6) names, surnames, positions, telephone numbers and addresses of electronic mailboxes of other employees responsible for the implementation of the provisions of the Act, whom the obligated institution is willing to indicate for contacts with the GIIF (contact persons);

7) name (company) and NIP or name, surname and PESEL of the intermediary entity referred to in Article 73(1) − in the case of using the intermediation of this entity.

Submitting quarterly form by VASP

As with identification form of VASP in Poland, quarterly form may be submitted only by person who has qualified electronic signature and only via GIIF’s online system. Moreover, it may be submitted only by person indicated in VASP identification form as AML Officer or contact person.

Quarterly form is available only after identification form is properly submitted and only after logging into GIIF’s online system. Logging take place by using qualified electronic signature.

Quarterly form contains around 300 questions. Final number of questions depends on VASP factual business activity in the field of virtual currencies:

a) exchange between virtual currencies and means of payment;

b) exchange between virtual currencies;

c) intermediation in the exchange referred to in letter a and b;

d) keeping maintaining the accounts in electronic form, of identifying data enabling the entitled persons to use virtual currency units, including the conduct of transactions of their exchange.

Questions in quarterly form are grouped into interactive sections. Each section has to be manually fulfilled.

Deadline of submitting quarterly first form for 4th quarter of 2023 is 22/01/2024

Final form of quarterly report

Important notes and definitions:

- VASP – the obliged entity which is submitting quarterly report;

- value of transactions converted to EUR means a question about the sum of all transactions from a given quarter after converting the value of each transaction to EUR from the transaction date;

- Polish AML Act at it latest official English version

- active client means a client to whom VASP applies simplified financial security measures, a client who has at least one product, or has active access to transaction services, or can complete a transaction without any additional activities.

Section 1 (Grupa 1)

AML Activities (Działalność AML)

AML Activities letter A – exchange between virtual currencies and means of payment

- Is entity entered in the VASP Register, related to conducting the activity mentioned in Article 2(1)(12)(a) of the Polish AML Act – (exchange between virtual currencies and means of payment)?

- Does the entity actually conduct the activity mentioned in Article 2(1)(12)(a) of the law?

- Date of commencement of the activity mentioned in Article 2(1)(12)(a) of the law?

- Are there limits for clients regarding the number of transactions they can conduct with the VASP in the context of the activity mentioned in Article 2(1)(12)(a) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value (in the case of different limits for different types of transactions, enter the highest limit): Enter Value

- Are there limits for clients regarding the value of transactions they can conduct with the VASP in the context of the activity mentioned in Article 2(1)(12)(a) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value converted to EUR

(in the case of different limits for different types of transactions, enter the highest limit): Enter Value

Section 1 (Grupa 1)

AML Activities (Działalność AML)

AML Activities letter B – exchange between virtual currencies

- Is entity entered in the VASP Register, related to conducting the activity mentioned in Article 2(1)(12)(b) of the Polish AML Act – (exchange between virtual currencies)?

- Does the entity actually conduct the activity mentioned in Article 2(1)(12)(b) of the law?

- Date of commencement of the activity mentioned in Article 2(1)(12)(b) of the law?

- Are there limits for clients regarding the number of transactions they can conduct with the entity in the context of the activity mentioned in Article 2(1)(12)(b) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value (in the case of different limits for different types of transactions, enter the highest limit): Enter Value

- Are there limits for clients regarding the value of transactions they can conduct with the entity in the context of the activity mentioned in Article 2(1)(12)(b) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value Value converted to EUR

(in the case of different limits for different types of transactions, enter the highest limit): Enter Value

Section 1 (Grupa 1)

AML Activities (Działalność AML)

AML Activities letter C intermediation in the exchange between virtual currencies and means of payment and between virtual currencies

- Is entity entered in the VASP Register, related to conducting the activity mentioned in Article 2(1)(12)(b) of the Polish AML Act – (intermediation in the exchange between virtual currencies and means of payment and between virtual currencies)?

- Does the entity actually conduct the activity mentioned in Article 2(1)(12)(c) of the law?

- Date of commencement of the activity mentioned in Article 2(1)(12)(b) of the law?

- Are there limits for clients regarding the number of transactions they can conduct with the entity in the context of the activity mentioned in Article 2(1)(12)(c) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value (in the case of different limits for different types of transactions, enter the highest limit): Enter Value

- Are there limits for clients regarding the value of transactions they can conduct with the entity in the context of the activity mentioned in Article 2(1)(12)(c) of the law?

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value, Value converted to EUR

(in the case of different limits for different types of transactions, enter the highest limit): Enter Value

Section 1 (Grupa 1)

AML Activities (Działalność AML)

AML Activities letter D – keeping maintaining the accounts in electronic form, of identifying data enabling the entitled persons to use virtual currency units, including the conduct of transactions of their exchange

- Is the entity in the register of activities related to virtual currencies, as mentioned in Article 129m of the law, registered for conducting the activity specified in Article 2(1)(12)(d) of the law – (keeping maintaining the accounts in electronic form, of identifying data enabling the entitled persons to use virtual currency units, including the conduct of transactions of their exchange)?

- Does the entity actually conduct the activity specified in Article 2(1)(12)(d) of the law?

- What is the commencement date of the activity specified in Article 2(1)(12)(d) of the law?

- The limit on the number of transactions using the account referred to in Art. 2 section 2 point 17) letter e) run by IO for customers

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value (in the case of different limits for different types of transactions, enter the highest limit): Enter Value

- The limit on the value of transactions using the account referred to in Art. 2 section 2 point 17) letter e) run by IO for customers

Available answers: Yes / No

Select limit type: yearly, quarterly, monthly, daily, hourly.

Limit value, Value converted to EUR (in the case of different limits for different types of transactions, enter the highest limit): Enter Value

- Limit on the number of accounts

Available answers: Yes / No

Limit value: Enter Value

- Balance limit

Available answers: Yes / No

Limit value: Enter Value

Section 1 (Grupa 1)

Money Laundry Prevention (Prewencja Prania)

AML Officer – person appointed according to Article 8 of Polish AML Act

- Date of appointment

- Name, surname

- Middle names if applies

- PESEL number if applies

Section 1 (Grupa 1)

Money Laundry Prevention (Prewencja Prania)

Risk assessment pursuant to Article 27 section 1 of Polish AML Act

- Date of preparation

- Update date

Section 1 (Grupa 1)

Money Laundry Prevention (Prewencja Prania)

Sanction lists according to Article 118 section 1 of Polish AML Act – lists of persons and entities related to threats to international peace and security caused by terrorist acts

- Is the customer base of the obligated institution and potential customers (before establishing business relations) checked for their presence on the lists pursuant to Art. 118 section 1 of the Act?

- Frequency of check:

Available answers: once a day, more than once a day, less than once a day

- Method of ensuring compliance:

Available answers: manually by representative of VASP; manually by representative of VASP with using IT methods; automatic IT scanning method

Section 1 (Grupa 1)

Money Laundry Prevention (Prewencja Prania)

Frozen Funds

This subsection refers to the freezing of financial resources, funds or economic resources pursuant to the provisions of Regulation 765/2006, Regulation 269/2014, the Act of April 13, 2022 on special solutions for counteracting support for aggression against Ukraine and for the protection of national security (sanction lists specified in the above-mentioned EU regulations and the so-called list of the Ministry of Interior and Administration).

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Capital Group

- Is VASP a commercial company?

- Is VASP a member of a capital group within the meaning of the Accounting Act?

- How many entities are part of the capital group within the meaning of the Accounting Act to which OI belongs?

- How many entities from the capital group within the meaning of the Accounting Act to which OI belongs have their registered office outside of Poland?

Capital group – this term refers to a dominant entity along with its subsidiaries;

Dominant entity – this term refers to a commercial company or state enterprise exercising control over a subsidiary, in particular:

a) directly or indirectly holding the majority of the total number of votes in the governing body of the subsidiary, also based on agreements with other voting rights holders who exercise their voting rights in accordance with the will of the dominant entity, or

b) being a shareholder of the subsidiary and authorized to direct the financial and operational policy of the subsidiary independently or through individuals or entities designated by itself based on an agreement with other voting rights holders, including the dominant entity, holding the majority of the total number of votes in the governing body, or

c) being a shareholder of the subsidiary and authorized to appoint and dismiss the majority of members of the management, supervisory, or administrative bodies of the subsidiary, or

d) being a shareholder of the subsidiary, of which more than half of the composition of the management, supervisory, or administrative bodies in the previous financial year, during the current financial year and until the financial statements for the current financial year are prepared, are individuals appointed to perform these functions as a result of the exercise by the dominant entity of the voting right in the bodies of the subsidiary, unless another entity or person has rights in relation to the subsidiary as mentioned in points a, c, or e, or e) being a shareholder of the subsidiary and authorized to direct the financial and operational policy of the subsidiary based on an agreement with the subsidiary or the statute or agreement of the subsidiary;

Subsidiary – this term refers to an entity that is a commercial company or an entity created and operating in accordance with the laws of foreign commercial law, controlled by the dominant entity.

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who are entered into Polish register of the activities in the field of virtual currencies

Is

– member of a capital group within the meaning of the Accounting Act, to which VASP belongs,

– the beneficial owner of VASP, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

registered in the Polish register of activities in the field of virtual currencies referred to in Article 129m of the Act (Polish VASP Register)?

Indicate Tax Identification number of such entities/ persons

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who conduct activities in the field of virtual currencies in the EEA outside Poland

Is

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

authorized to conduct business in the field of virtual currencies in EEA country outside Poland?

Indicate country of the entity

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who has seat or place of residence outside EEA:

- Is

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

–– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

conducting business in the field of virtual currencies (being provider of virtual assets services within the meaning of the glossary of the FATF Recommendation of 2012) in non EEA country?

Indicate country

- Was

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

subject to decision on revoking license to conduct business in the field of virtual currencies (being provider of virtual assets services within the meaning of the glossary of the FATF Recommendation of 2012) in non EEA country?

Indicate country and date

- Did

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

cease to conduct business in the field of virtual currencies (being provider of virtual assets services within the meaning of the glossary of the FATF Recommendation of 2012) in non EEA country?

Indicate country and date

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who are obligated institutions within the meaning of Art. 2 section 1 points 1)-11) and 13)-26) of the Act.

Is

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

obligated institution within the meaning of Art. 2 section 1 points 1)-11) and 13)-26) of the Polish AML Act?

Indicate Tax Identification number

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who has registered office or place of residence in the EEA (excluding Poland)

Is

– member of a capital group within the meaning of the Accounting Act, to which VASP belongs,

– the beneficial owner of VASP, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

obligated institution within the meaning of Art. 2 section 1 point 1) or 2) AMLD4 or f Art. 2 section 1 point 3) letters a) – f), i) and j) AMLD4 with its registered office in an EEA country other than Poland?

Indicate entity country

Section 1 (Grupa 1)

Activity performed by capital group or related entities (Działalność prowadzona przez grupę kapitałową lub podmioty powiązane)

Related to VASP entities or persons, which or who has registered office or place of residence outside EEA

Is

– member of a capital group within the meaning of the Accounting Act, to which OI belongs,

– the beneficial owner of OI, or

– a person designated under Article 6, 7, 8 of the AML Act –top-level management responsible for performing duties specified in the law, management, or other governing body, or an employee holding a managerial position responsible for ensuring compliance with the institution’s activities and its employees or individuals performing activities for this institution obligated by anti-money laundering and counter-terrorism financing regulations, and the implementation of obligations specified in the law,

financial institution within the meaning of the glossary of the FATF Recommendation of 2012 in a non-EEA country or designated entity or profession providing non-financial services within the meaning of the glossary of the FATF Recommendation of 2012 in a non-EEA country?

Indicate country

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Total

- Number of clients subjected to analysis for the identification of suspicious circumstances or transactions.

- Number of reports of suspicious circumstances or transactions submitted to the AML/CFT unit, e.g., non-system reports (any channel) from branch employees, intermediaries, franchisees, distributors.

- Number of individuals directly responsible for the current analysis of transactions (excluding employees dedicated exclusively to customer service).

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 41 (1) of Polish AML Act

- Number of cases specified in Article 41(1)(1) of the law – refusal to establish a business relationship.

- Number of cases specified in Article 41(1)(2) of the law – refusal to execute an occasional transaction.

- Number of cases specified in Article 41(1)(4) of the law – termination of business relationships.

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 41 (2) of Polish AML Act

- Number of clients reported to GIIF in connection with the application of Article 41(2) of the Polish AML Act.

- Number of notifications resulting from Article 41(2) of the Polish AML Act.

Article 41. 1. Should the obligated institution be unable to apply one of the customer due diligence measures referred to in Article 34(1):

1) it shall not establish a business relationship;

2) it shall not perform an occasional transaction;

3) it shall not conduct transactions through the bank account;

4) it shall terminate a business relationship.

2. The obligated institution shall assess whether the inability to apply the customer due diligence measures referred to in paragraph 1 forms basis for providing the General Inspector with the notification referred to in Article 74 or Article 86.

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 74 of Polish AML Act

- Number of clients reported to GIIF based on Article 74(1) of the Polish AML Act.

- Number of notifications reported to GIIF based on Article 74(1) of the Polish AML Act.

Notification to GIIF of circumstances that may indicate suspicion of money laundering or terrorism financing

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 86 (1) of Polish AML Act

- Number of clients reported to GIIF based on Article 86(1) of the Polish AML Act.

- Number of notifications reported to GIIF based on Article 86(1) of the Polish AML Act.

Notification to GIIF having reasonable suspicion that a specific transaction or specific financial values may be related to money laundering or terrorism financing

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 90 (1) of Polish AML Act

- Number of clients reported to GIIF based on Article 90(1) of the Polish AML Act.

- Number of notifications reported to GIIF based on Article 90(1) of the Polish AML Act.

Notification to the GIIF via electronic communication means of the transaction mentioned in Article 86(1) of Polish AML Act when reporting was impossible before its execution

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 90 (2) of Polish AML Act

- Number of clients reported to the prosecutor based on Article 90(2) of the Polish AML Act.

- Number of notifications reported to the prosecutor based on Article 90(2) of the Polish AML Act.

Notifying the relevant prosecutor of the transaction mentioned in Article 89(1) when reporting this transaction was impossible before its execution

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Article 61a (2) of Polish AML Act

- Number of clients for whom discrepancies in ultimate beneficiary data were reported, based on Article 61a (2) of the Polish AML Act.

Section 1 (Grupa 1)

Notices – Reporting obligations (Zawiadomienia)

Account blocks

86 (10) of Polish AML Act – Number of cases specified in Article 86(10) of the Polish AML Act, in which the prosecutor suspended the transaction or imposed a block – suspension or account block for a period determined by the prosecutor despite the lack of GIIF notification

- 86 (5) of Polish AML Act – Number of clients subject to Article 86(5) of the Polish AML Act, i.e., GIIF forwarded a request for suspension of transactions or account block to the VASP for a period not exceeding 96 hours.

- 86 (9) of Polish AML Act – Number of clients subject to Article 86(9) of the Polish AML Act, i.e., the prosecutor suspended the transaction or imposed a block for a specified period.

- 87 (1) of Polish AML Act – Number of clients subject to Article 87(1) of the Polish AML Act, i.e., GIIF issued a request for suspension of transactions or account block for a specified period not exceeding 96 hours