As of the beginning of November 2019 the provisions regarding obligatory split payment in Poland come into force. It is worth underline that this obligation may also apply to a large part of small companies in Poland, including entities conducting sole proprietorship.

What is split payment?

Split payment generally has to be defined as:

- payment of the amount of net sales value resulting from the received invoice to the bank account which is linked to the special VAT account;

- payment of the amount of VAT resulting from the invoice to the special VAT account of seller.

Each Polish VAT taxpayer has a special VAT bank account created by the bank with no possibility to freely dispose of funds located on this account. Of course, the funds on this account are your property, but access to them is limited. On this account, after the payment is divided into two ways, the amounts of VAT are transferred.

The VAT account is separated by the bank as part of the polish entrepreneur’s basic account. If he has several settlement accounts, a VAT account is opened for each of them.

Funds located in special VAT account are available for payment of tax liabilities to the tax office, payment to the contractor in part of the VAT amount and paid to the ordinary taxpayer’s account, which will be made upon request to the tax office.

When split payment is applied?

The obligatory split payment in Poland will be applied to the sale of services and goods listed in Annex 15 to the VAT Act, if the gross amount of the transaction is equal or higher than PLN 15,000, where the seller and buyer are VAT payers.

Therefore, obligatory split payment is applied only when following circumstances take place:

- subject of the invoice are goods/services listed in Annex 15 to the VAT Act;

- both seller and buyer are VAT payers (only B2B business relations);

- amount indicated in the invoice is equal or higher than PLN 15,000 gross..

Seller's obligations:

VAT tax payer selling goods or services listed in Annex 15 is obligated to indicate on invoice “split payment regime”.

If the invoice is issued without this indication, the seller will be able to correct it by issuing a correcting invoice.

Sanctions:

- The seller may receive a penalty equal to 30% of the value of VAT resulting from invoice in which is not indicated information that transaction is subject to a split payment in Poland regime. This sanction will not apply if the buyer paid the VAT amount using the split payment mechanism;

- The buyer may receive a penalty equal to 30% of the VAT value resulting from invoice not paid in the split payment regime. This sanction will not apply if the seller settle the entire tax resulting from the invoice;

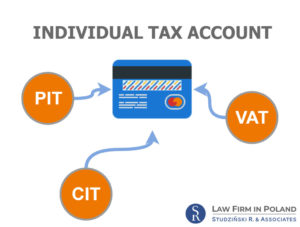

- The buyer will not be entitled to include the amount of the expenditure (CIT / PIT) as tax deductible if he settle invoice without using split payment regime