As of 29 September 2023 and 1 January 2024 and 29 March 2024 new regulation connected with requirements of SPI in Poland comes to force. Significant amendments to Polish Payment Services Act are effective which regulate Small Payment Institution activity in far more strict way. New regulations apply to

- process of registration of Small Payment Institution – new formal requirements have been established;

- reporting obligations of Small Payment Institution

Process of registration of Small Payment Institution (effective as of 29 September 2023)

Entry Polish company into Small Payment Institution Register (obtaining SPI license in Poland) was drastically changed.

Applicant has to attach to motion on obtaining SPI license, following documents:

- The list of payment services which the Small Payment Institution intends to provide, including the presentation of these services in the form of a graphic diagram with a description of these services and the indication of the service types listed in Polish Payment Services Act to which these services belong;

- Description of organizational solutions, which allow:

a) calculation of the total monthly amount and payment transactions,

b) fulfillment of obligations related to anti-money laundering and counter-terrorism financing as per the Polish AML Act. - Business activity program and financial plan covering a full 12-month period of SPI’s operations, taking into account the transaction value limit requirement;

- Risk management procedures to which SPI may be exposed;

- Description of any business activity other than providing payment services;

- Description of the method for safeguarding clients’ monetary funds;

Business activity program and financial plan covering a full 12-month period of SPI's operations, taking into account the transaction value limit requirement

Pursuant to Article 117h(2)(1) of the Polish Payment Services Act, Small Payment Institution is obliged to have a program of operations and a financial plan for the first 12 months of its activity. Program has to take into account the requirement not to exceed the equivalent of EUR 1 500 000 of the average total amount of payment transactions over the previous 12 months performed by the Small Payment Institution. A properly drawn up business plan should be correct in formal, factual and accounting terms.

Formal correctness is expressed in the completeness in terms of essential elements and in the layout of the content according to the minimum standards referred to below.

Substantive correctness is primarily the correctness of the data and assumptions made, as well as their plausibility, i.e. the correspondence of the initial data with the actual state of affairs and the correspondence of the assumed values with the rational, probable scenario of the company’s development in the given market and macroeconomic conditions.

Accounting accuracy consists of the correct, orderly and free of accounting errors presentation of financial statements presenting input data, output data and the indicators and measures resulting from the compilation of these data.

In terms of minimum standards, the SPI’s program of activities should, include:

- strategic assumptions;

- a marketing plan including:

- characteristics of the services provided,

- characteristics of the target client group,

- an analysis of the services provided by other suppliers to the extent that these suppliers are in competition with SPI,

- a pricing strategy,

- a description of the intended channels of distribution and promotion of services;

- an operating plan containing data on:

- capital expenditures and sources of their financing,

- sources of funding for operational activities,

- implementation of legal and supervisory requirements for the operation of the SPI,

- the policy on the outsourcing of payment services, including the applicant’s contractual rights and obligations,

- the technology used, taking into account the design of the IT systems architecture, including a description of the production and back-up IT environment, a description of the technical security features and tools, the way in which transactions are monitored, data flows, the software used and the security of data and systems,

- the flow of information between all parties involved in the execution of a payment order and the flow of funds between accounts, indicating the sequence in which they occur in the provision of payment services;

- an organization and management plan, containing in particular a description of the organizational structure, the powers of the organs or managers, the employment policy, as well as the applicant’s internal regulations and procedures, including those relating to corporate governance, internal control, accounting and auditing;

- a timetable setting out the planned dates for the achievement of the various business milestones and strategic objectives set out in the business plan. The financial plan, on the other hand, should include revenues, costs, profits and losses, capital expenditures, capital requirements, sources of funding for operations, cash flow, balance sheet and financial evaluation with an assessment made on the basis of the statements of the financial plan and an indicator assessment.

Description of organizational solutions

According to Article 117h(1)(1) of the Polish Payment Services Act, activities of Small Payment Institution may be carried out if is has organizational arrangements allowing for:

- calculate the total monthly amount of payment transactions,

- the performance of obligations relating to the prevention of money laundering and terrorist financing in accordance with the relevant legislation in force.

These solutions should include, in particular, a fixed (written or electronic) recording of each single transaction with its amount and all data necessary from the point of view of AML/CFT obligations and the documentation supporting these data. In addition, these solutions should enable the processing of the collected data and, in particular, the immediate generation of summaries of the data for the purposes of both the SPI activity and the supervisory activities of the Polish Supervision Financial Body.

Risk management procedures to which SPI may be exposed

Small Payment Institution is required to have an up-to-date procedure for managing the risks to which it may be exposed. This procedure should, in particular, address and describe the principles of:

- risk identification,

- risk analysis,

- risk response planning,

- risk monitoring and control.

Description of the method for safeguarding clients' monetary funds

Pursuant to Article 117o of the Polish Services Act, the Small Payment Institution is obliged to protect funds received from users, including funds received through agents or other providers for the purpose of executing payment transactions. The provisions of Articles 78 and 80 of the Polish Services Act and the implementing regulations issued on the basis of Article 79 of the Act (Regulation of the Minister of Finance of 13 August 2012 on the categories of assets and the maximum proportion of cash invested by national payment institutions)

Summary

As you can see, documents which has to be accompanied with motion for entry company into SPI register characterize individual approach for each undertaking. Their content depends on applicant’s scope of business activity. Moreover, taking into consideration requirements of above mentioned documents, Client has to take part actively in process of registration. In particular, our Law Firm in Poland needs from Client very detailed description of planned undertakings. Furthermore, there is no possibility to use templates of documents. Documents have to be individually prepared for each Client.

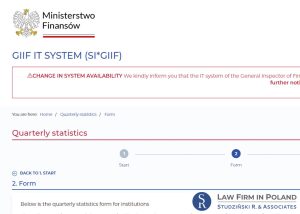

Reporting obligations

New regulation of Polish AML Payment Services Act are connected also with new reporting obligation of Small Payment Institution. SPI has to provide Polish Financial Supervision Authority (pl: “KNF”) with IBAN number and copy of bank account agreement. Moreover, as of 29 March 2023, Small Payment Institution has to open separate bank account, which will be used only for services enabling cash withdrawals from a payment account as well as all the operations required for operating a payment account.

Furthermore, current reporting obligations of Small Payment Institution regarding amount and value of rendered payment services has to be divided into each type of payment services.