As of 1st November 2021, business in the field of cryptocurrency in Poland became regulated. As of this date, Cryptocurrency Register in Poland was activated. Therefore, obtaining crypto license in Poland has to be understood as entry into Polish Register of Virtual Currency activities.

Some basic information about Polish Register of Virtual Currency Activities were presented by our Law Firm in Poland in following article. However, because of enormous interested in obtaining crypto license in Poland and requests for additional information about Polish legal environment of cryptocurrency business activity, we decided to prepare complex answers to common questions.

1. Does foreign company may be entered into Polish Cryptocurrency Register?

The Polish AML Act does not provide us with answer for the above question. Moreover, its to early to say how practice will look in that regard. However, in accordance with Article 5 of the Act of 6 March 2018 on the rules of participation of foreign entrepreneurs and other foreign persons in economic activity on the territory of the Republic of Poland, a foreign entrepreneur from a Member State may temporarily provide services without the need to be entered in the Polish Commercial Registers (the National Court Register or the Central Register and Information on Economic Activity). Therefore, business activity of the foreign company may be only occasional (temporal) in Poland. Entry into register of regulated activity in Poland has to be recognized as contradictory to temporal activity. It is quite opposite, it reflects regularity of business in Poland. For this reason, in opinion of our Law Firm in Poland foreign entity can not be entered into Polish Cryptocurrency Register.

2. What is the relevant legislation in Poland regulating the cryptocurrency?

The main act, which concerns aspects of business activity in the field of virtual currencies is the Polish Act of March 1, 2018 on counteracting money laundering and financing of terrorism (Polish Journal of Laws 2021, item. 1132, 1163, 1535 – consolidated text).

Articles of Polish AML Act, which regulates Polish Register of Cryptocurrencies Business are: Art. 129m to Art. 129z.

3. What are the conditions of entry Polish entity into Register of Virtual Currencies activities?

Entry into Cryptocurrency Business Register in Poland requires to meet following conditions:

- special qualification requirement:

Representatives of Polish cryptocurrencies companies are required to have knowledge or experience related to the activities in the field of virtual currencies. According to Polish AML Act this condition is fulfilled after:- completing a training or course covering legal or practical issues related to the virtual currencies activity; or

- performing activities in the field of virtual currencies for a period of at least one year, which has to be proved by relevant documents.

- no criminal record requirement:

Representative of company in Poland can not be convicted of an intentional crime against the activity of state institutions and local government, against the administration of justice, against the credibility of documents, against property, against economic turnover and property interests in civil law transactions, against money and securities trading, and also offense committed for the purpose of material or personal gain or an intentional fiscal offense. The above mentioned requirement of no criminal record in Poland shall apply also to the beneficial owner of the cryptocurrency company in Poland.

4. How representatives of Polish company can fulfill requirements of experience or knowledge in the field of virtual currencies activity?

First of all, it has to be outlined, that experience and knowledge of the director in the field of virtual currencies is not examined by authority upon proceedings on entry company into Crypto Register in Poland. Representative of Polish company has to only sign statement that company complies with all obligation stipulated in Polish AML Act. Content of the statement is following:

“I declare that the data contained in the application are complete and true. I am familiar with the conditions for the performance of activities in the field of virtual currencies referred to in the Act of March 1, 2018 on the prevention of money laundering and terrorist financing. In particular, I declare that the conditions referred to in Articles 129n and 129o of the said Act are met.

I am aware of the criminal liability for making a false statement.”

Nevertheless, our Law Firm in Poland encourage clients to comply with experience or knowledge requirement, because of criminal liability involved for submitting false statement. Moreover, according to article 129w Polish AML Act:

the authority competent for the register of activities in the field of virtual currencies shall, by way of a decision, remove the entity performing activities in the field of virtual currencies from this register, among others if it is found that declaration (declaration that company meets all requirements) is inconsistent with the facts.

Our Law Firm in Poland assists clients with online course issued by the General Inspector of Financial Information (Polish AML Regulator). Course consists in around 500 (five hundred) slides. Moreover, user has to pass final test. After that he/she may obtain certificate proving his knowledge in respect of Polish AML regulations.

5. What kind of documentation is required to prove that the director has prior experience in the field of virtual currencies?

Currently, there is no explanation and any comment regarding compliance with the requirement of performing by representative activities in the field of virtual currencies for a period of at least one year . The regulations will probably remain unclear in this respect. That’s why we encourage our clients to obtain AML certificate from Polish Regulator – please check answer for question no 4.

6. How director may present his clear criminal record? Does it have to be issued by country of citizenship? Does non-criminal record requirement apply only to representative of the company?

As with the experience and knowledge requirement, director of Polish company is not obligated to present his non-criminal certificate in Poland in proceeding on entry into Polish Crypto Register. Statement submitted by the representative concerning that all requirements of entry into Crypto Register in Poland is sufficient.

It has to be noted that requirement of no criminal record in Poland applies also to the beneficial owner of the cryptocurrency company in Poland

7. What are the regulatory requirements for the crypto service providers that Polish company should be familiar with?

First of all, it has to be outlined that Polish crypto company has to be recognized as obliged institution – pl: “instytucja obowiązana”, or according to EU AML Directives “obliged entity”. Under Polish AML Act obliged institutions have to complete with certain obligations. These obligations of Polish financial institution may be divided into following groups:

- Implementation of an internal procedure on combating money laundering and terrorist financing – AML Policy;

- Application the financial security measures to customers in certain circumstances – KYC/ Client Identification procedure;

- Reporting the General Inspector of Financial Information in certain situations;

- Designation of senior management responsible for implementing the duties set out Polish AML Act;

- Performing training programmes to personnel covering the execution of AML obligations.

Please check brief information of AML obligations of Polish cryptocurrencies business entity in our article: https://www.lawfirmpoland.com/aml-standards-manual-in-poland/

8. As the company is required to carry out certain obligations set out under the Polish AML legislation (internal procedures, policies, training, reporting etc.), does the Polish company have to submit any kind of documentation to the regulator while registering its crypto businesses?

There is no obligation to present any internal AML documentation via process of entry Polish company into Cryptocurrency Register.

9. What services may Polish crypto service providers offer and what are the available products i.e. crypto to fiat, crypto to crypto and fiat to crypto?

Crypto license in Poland covers 4 main activities:

- exchange between virtual currencies and means of payment;

- exchange between virtual currencies;

- intermediation in the exchange referred to in letter a and b;

- keeping maintaining the accounts in electronic form, of identifying data enabling the entitled persons to use virtual currency units, including the conduct of transactions of their exchange

Polish company may hold all 4 licenses or choose only some of them. General requirements stipulated in answer for 3rd na 4th question applies to all subjects of business activity in the field of virtual currencies.

10. What is time frame of entry company into Crypto Register in Poland?

Already registered Polish company may be entered into Polish Register of Virtual currencies within 14 days from date of submission of the motion. 14 days is indicative time and may be prolonged by authority holding Crypto Register in Poland.

11. What is capital requirements to be held through the business activities in the field of virtual currencies?

Minimum share capital of Polish Limited Liability Company (“Sp. z o.o.” ) is PLN 5.000. Our Law Firm in Poland recommend staying with minimum share capital of 5.000 złotych. Higher share capital is connected with higher incorporation fees. Moreover, it has to be underlined that shareholder is not obligated to transfer this amount into company’s bank account. Client has to only sign statement that share capital is covered by PLN 5.000. PLN 5.000 of share capital is sufficient for obtaining crypto license in Poland.

12. What is the required structure of Polish crypto company in terms of directors and shareholders? Do shareholders of Polish company in Poland may be foreigners? Does company require to have local directors?

First of all, in corporate structure of Polish Limited Liability company there may be only one physical person. This person may combine function of sole shareholder (UBO) and President of the Management Board (director) of the company .

Moreover, both director and shareholder may be foreigners (also citizens of non EU states). It has to be underlined that Polish Limited Liability Company does not require to have in its structure local director (with place of residence in Poland). However, according to Polish Act on National Court Register members of the management board of a limited liability company in Poland are required to inform the Register about their correspondence address. If the residence address of members of the management board is outside Poland, representative of the company has to indicate an Attorney for Service on territory of Poland. Without appointment of such attorney foreigner can not be enclosed in Commercial Register as representative of the company. Upon formation of the company services, our Law Firm in Poland acts as delivery agent of the directors. That’s why it is crucial to use services of licensed law firm in process of Polish company formation.

13. Does Polish crypto company have to appoint AML Officer?

One of the main obligation of Polish crypto company is designation of senior management, who will be responsible for implementing the duties set out in Polish AML Act. Designation takes place on basis of internal document of the company – resolution of the Shareholders Meeting. Therefore, company is not obligated to appoint AML Officer other than director. In Polish company entered into Polish Register of Virtual currencies Business activity, there may be only President of the Management Board (director), who can also be sole shareholder of the company. This person may be also responsible for obligations which rise from Polish AML Act.

14. What is the name of Polish Regulator Authority in scope of business activity in the field of cryptocurenncies?

The authority of Polish government administration exercising control over the compliance with the provisions on counteracting money laundering and terrorist financing is the General Inspector of Financial Information, Świętokrzyska 12 Street, 00-916, Warsaw, Republic of Poland. (pl: “Generalny Inspektor Informacji Finansowej”) webpage: https://www.gov.pl/web/finanse/generalny-inspektor-informacji-finansowej

15. Which Polish authority does hold the Polish Cryptocurrency Register?

Upon delegation of Polish Ministry of Finance, the holder of Polish virtual currencies business activity register is Tax Office in Katowice. Only Tax Office in Katowice is the holder of Crypto Register in whole Poland, regardless of the seat of Polish company.

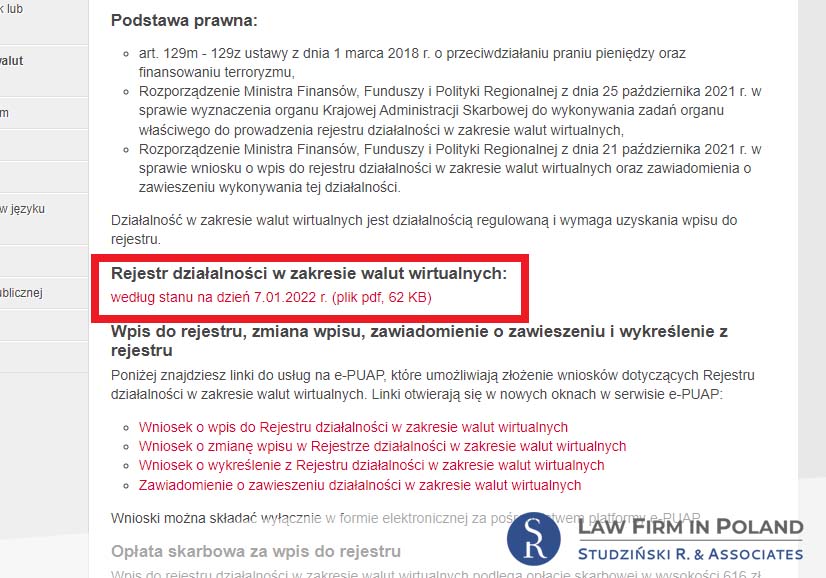

16. Where Polish Crypto Register can be found? Is it available online?

Polish Virtual Currencies Business Activity Register it is enclosed on following webpage:

Currently, Polish Crypto Register has a form of PDF file, which is available to download from above mentioned government webpage. Register is updated (PDF file is modified) systematically by Polish Authority which held Register.

17. Does the Polish Crypto company have to have local office?

Company conducting business activity in the field of virtual currencies may use services of Virtual Office provider (rent only address of the company).

18. When Polish crypto license may be revoked/terminated?

Under Article 129w. of Polish AML Act, the authority competent for the register of activities in the field of virtual currencies shall, by way of a decision, remove the entity performing activities in the field of virtual currencies from this register:

- at the request of the entity, submitted in electronic form;

- after obtaining information on the removal of the entity from the Commercial Register in Poland;

- if it is found:

- the entity’s failure to meet the conditions required by law to perform activities in the field of virtual currencies,

- the entity submitted the declaration (declaration that company meets all requirements) inconsistent with the facts

19. Does the Polish Regulator carry out on-site visits or audits to check whether the polish crypto company is abiding by the mandatory AML rules?

The General Inspector of Financial Information exercise the control of the obligated institutions’ compliance with the obligations in the scope of counteracting money laundering and financing of terrorism. In the framework of the supervision or control performed, the control is also exercised by heads of customs and tax control offices.

The controls are performed based on annual control plans containing in particular the list of entities subject to control, the scope of control and the justification of its performing. However, audits may be carried out also without schedule in the annual control plan (the ad-hoc audits).

AML Audit is performed by at least two employees of the control authority personally authorized by the General Inspector. The inspectors shall perform control activities at the place of business of the controlled obligated institution and in any other place associated with its business, on business days and within the working hours of the controlled obligated institution. In the event of suspected committing of a crime or a fiscal offence, urgent control activities can be undertaken on non-business days or beyond the working hours of the controlled obligated institution, after a prior notification of a person authorized to represent the controlled obligated institution. Moreover, the control activities can be also undertaken outside those places, in particular on the premises of the controlling authority, if this is justified by the nature of such activities and if it can contribute to faster and more effective performing of the control. Each inspector shall be authorized to move freely across the sites and premises of the obligated institution without having to obtain a pass and shall not be subject to personal control. The control activities shall be carried out in the presence of the person authorized by the controlled obligated institution.

After the completion of control activities, however, prior to signing a control report, the inspectors may request the controlled obligated institution to submit additional documents and written explanations in the scope covered by the control, within the time limit prescribed.

21. Does exhange of cryptocurrency in Poland is subject to VAT?

The exchange or sell cryptocurrencies in Poland is not subject of Value Added Tax (VAT).

22. Is it possible to open bank account in any Polish "traditional" banks for company operates business activity in the field of cryptocurrencies?

Our Law Firm in Poland cooperate with managers of one of the biggest and most popular banks in Poland for business and individual clients. In particular, we cooperate with ING Bank, PEKAO, Santander Bank.

All Banks provide access to bank account via internet service, which are in English language version. Moreover clients of those banks are supported by phone consultants, which speak English and can solve all problems regarding account.

However, you have to be advised that, as the rule, bank account has to be open in person in Poland and it requires personal visit in bank branch by representative of the company. It is impossible to open bank account via attorney in Poland in any Polish bank.

Unfortunately, currently new regulations of Polish Register of Business Activity in the field of Cryptocurrencies nothing change in regard of approach Polish banks to this type of business activity. All Polish banks are not crypto friendly. To open bank account my Clients have to present business activity connected with Computer programming activities; Computer facilities management activities; Other information technology and computer service activities; Web portals; Other information service activities not elsewhere classified. If Client presents any kind of relation with cryptocurrencies, banks will refuse any cooperation.

Does poland crypto license can be use in any countries?

Good question,is this EU recognized?